From prohibition to “Island Monaco” off Phuket Shores

For a country globally adored for its temples, beaches, and cuisine, Thailand’s stance on gambling has long been a paradox – firmly illegal in law, quietly embedded in daily life. Bordering several casino safe havens, Thailand has for decades been a popular choice among global poker enthusiasts. In turn, Shanghai and Singapore investors safehouses their profits from the entertainment business in Phuket real estate.

As debates intensify over a landmark legalization bill, a sweeping vision is emerging: luxury entertainment hubs with integrated resorts, marinas, theme parks, and – yes – casinos. And if private investors have their way, one of the most ambitious of them all will rise from the waters of Phuket – one that may safely be dubbed Thailand’s own “Island Monaco.”

The Entertainment Complex Bill

Thailand’s relationship with gambling is centuries deep. In the 19th century, under Kings Rama III and Rama V, government-run gambling dens were briefly legal, viewed as a source of state revenue. But as addiction and social issues grew, a moral backlash followed. In 1917, the dens were closed. The prohibition was codified in the Gambling Act of 1935, which outlawed almost all forms of gambling except for state lotteries and horse racing.

Since then, gambling has remained officially illegal and openly condemned by Thai society – yet persistently present. Underground betting dens, online platforms, cockfights, and cross-border casino trips to Cambodia and Laos are all part of the Thai social fabric.

These cross-border trips were particularly painful for Thailand – the world’s finest tourist destination was losing affluent clientele who were literally coming to give their hard-earned money away. Despite hosting 007-themed parties year-round, Phuket and Thailand have consistently failed to offer James Bond’s iconic indulgence – the casino experience.

In early 2025, Thailand’s Cabinet approved a draft bill titled the Integrated Entertainment Complex Act, aiming to legalize large-scale casino resorts under strict regulation. The bill is built on three pillars: tourism expansion, economic stimulation, and investor attraction.

Key features of the legislation include:

- Casinos limited to 5-10% of a complex’s floor space.

- Gross gaming revenue tax fixed at 17%, modeled on Singapore’s successful framework.

- Strict entry controls for Thai nationals, including a B5,000 per-visit fee and a financial proof requirement (up to B50 million).

- Mandatory player registration, anti-money laundering protocols, responsible gaming policies, and a blacklist mechanism for vulnerable groups.

- No less than B100-150 billion investment per complex

Economically, the numbers are staggering:

- B39 billion/year in casino revenue

- B12-40 billion/year in tax and fee revenue

- An additional B100-200 billion/year in tourist spending

- 9,000–15,000 jobs created and a potential 0.2-0.8% boost to GDP

Tourism officials also project that visitor arrivals could jump by 5-20% annually, and perhaps most importantly, rise during the low season months.

Notably, the bill encourages four initial locations – Bangkok, Chonburi, Chiang Mai, and Phuket – either to choose from or launch concurrently.

“Island Monaco” on the horizon

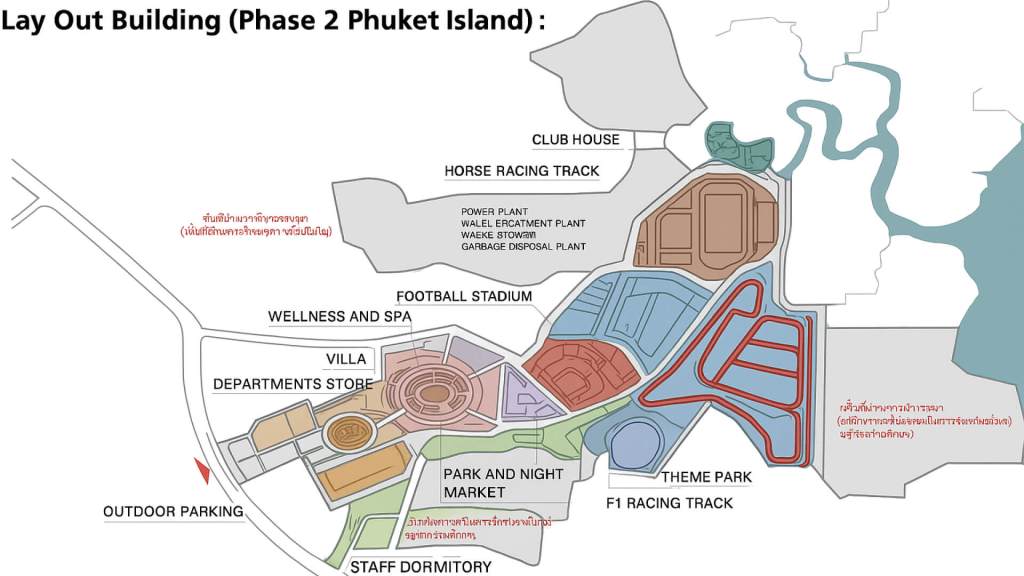

Among all the proposed developments, few are as bold as the project unveiled by the owners of the prestigious Royal Bangkok Sports Club (RBSC) and a group of unnamed investors with ties to Monaco and Hong Kong. Their plan? A B140 billion entertainment complex spanning 1,200 rai in Ao Po and on nearby Rang Yai Island.

The Rang Yai island phase will include:

- Casino 1 & 2

- Hotels

- Villas

- Yacht Club

- Yacht Port

- Ferry Port

- Immigration

- Department Store

- Convention Hall

- Spa

- Wellness Center

- Medical Center

- Fire Station

- Power Plant

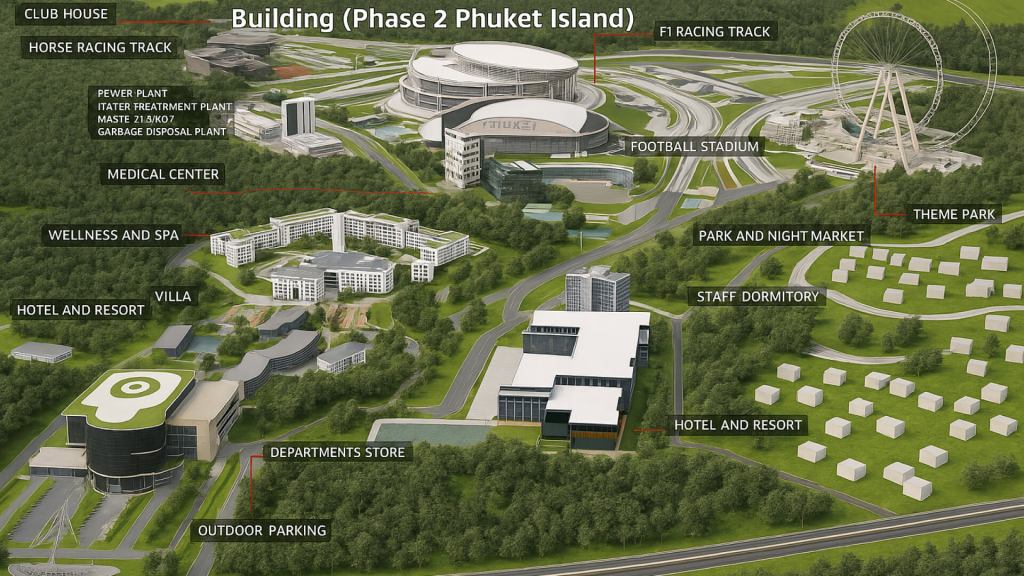

The Ao Po mainland phase will include:

- F1 Racing Track

- Horse Racing Track

- Football Stadium

- Theme Park

- Park and Night Market

- Club House

- Hotels and Resorts

- Villas

- Wellness and Spa

- Medical Center

- Department Store

- Outdoor Parking

- Power Plant

- Water Treatment Plant

- Fire Station

- Staff Dormitory

- Garbage Disposal Plant

Construction is slated to begin in Q1 2026, with Phase 1 projected to open in 2029 – whether or not the legislation is fully enacted. The casino will occupy just 3-5% of the total floor area, compliant with the new bill.

Investors believe Phuket’s international airport, existing luxury infrastructure, and appeal to ultra-wealthy travelers make it the ideal launch point.

But challenges loom. Phuket’s infrastructure is already under strain, with growing concerns over traffic congestion and unchecked development. The moral debate surrounding gambling remains unresolved, fueling resistance beyond the legislative halls. Recent anti-casino protests in Phuket are merely the visible tip of a deeper, widespread social sentiment – one that threatens to stall the bill like an iceberg beneath the surface.

Thailand is stepping into a game long played by neighbors like Singapore, Malaysia, South Korea, and the Philippines. From the drafting tables in Bangkok’s parliament to the pristine coastline of Phuket, the dice are already rolling.